The Financial Costs of Adopting a Pet

Lifestyle Adjustments and Associated Costs

Prioritizing Sleep

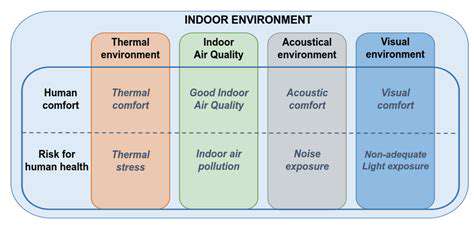

Adequate sleep is crucial for overall well-being and plays a significant role in managing stress and improving mood. Establishing a consistent sleep schedule, even on weekends, can regulate your body's natural sleep-wake cycle, leading to more restful sleep. Creating a relaxing bedtime routine, such as taking a warm bath or reading a book, can signal to your body that it's time to wind down.

Make your bedroom a sleep sanctuary by ensuring it's dark, quiet, and cool. Minimize distractions like electronic devices and bright lights before bed. If you're struggling with sleep, consulting a healthcare professional can help identify any underlying issues and provide personalized recommendations for improving sleep quality.

Mindfulness and Stress Management

Incorporating mindfulness practices, such as meditation or deep breathing exercises, can effectively manage stress and anxiety. These practices help to cultivate a sense of calm and awareness, allowing you to better navigate stressful situations. Regular mindfulness practice can significantly reduce the negative impact of stress on your physical and mental health.

Identifying and addressing the root causes of stress is also important. This may involve setting realistic expectations, learning to say no to commitments that overwhelm you, and seeking support from friends, family, or a therapist when needed.

Healthy Diet and Nutrition

Maintaining a balanced diet rich in fruits, vegetables, and whole grains is essential for supporting overall health and well-being. A nutritious diet provides the necessary vitamins, minerals, and nutrients to fuel your body and support optimal function. A balanced diet can also contribute to improved energy levels and reduced cravings for unhealthy foods.

Limiting processed foods, sugary drinks, and excessive intake of saturated and unhealthy fats is crucial for maintaining a healthy diet. Prioritizing whole, unprocessed foods can significantly impact your physical and mental health in a positive way.

Regular Physical Activity

Engaging in regular physical activity, such as exercise or sports, is beneficial for both physical and mental health. Physical activity helps to improve cardiovascular health, strengthen muscles and bones, and maintain a healthy weight. Regular exercise can also boost your mood, reduce stress, and improve sleep quality.

Finding activities you enjoy is key to maintaining a consistent exercise routine. This could include anything from brisk walking or swimming to joining a sports team or taking a dance class. The key is to find an activity that you can stick with long-term and that fits into your lifestyle.

Social Connection and Support

Maintaining strong social connections and seeking support from friends, family, or a support group can significantly impact your well-being. Having a strong support system can provide emotional and practical assistance during challenging times, and it can help to alleviate feelings of loneliness and isolation.

Cultivating meaningful relationships can boost your overall happiness and sense of belonging. Make time for social activities, nurture existing relationships, and consider joining groups or clubs with shared interests. These connections can provide encouragement and a sense of community that is invaluable for navigating life's challenges.

Adequate Hydration and Rest

Drinking plenty of water throughout the day is essential for maintaining optimal bodily functions. Water helps regulate body temperature, transports nutrients, and aids in digestion. Staying hydrated can also improve energy levels and cognitive function. Dehydration can lead to fatigue, headaches, and other negative effects.

Prioritizing adequate rest is just as important as getting enough sleep. Taking breaks throughout the day, even short ones, can help to reduce stress and improve focus. Rest allows the body to recover and recharge, which is essential for maintaining overall well-being.

Long-Term Costs: Aging and Potential Health Issues

Long-Term Care Costs

One of the most significant long-term costs associated with aging is the potential need for long-term care. This can encompass a range of services, from assisted living facilities to skilled nursing homes, and the associated expenses can vary drastically depending on the level of care required and the location. Determining the financial implications of potential future care needs is crucial for planning and ensuring adequate resources are available to manage these costs without jeopardizing other financial goals.

The escalating costs of healthcare, particularly in specialized facilities, can significantly strain family budgets. Proactive planning, including exploring various long-term care insurance options, can help mitigate these financial burdens and provide peace of mind for the future. These policies can help cover the expenses of care, freeing up personal finances for other needs.

Potential Health Issues and Associated Expenses

As we age, the likelihood of developing chronic health conditions increases, leading to a rise in medical expenses. Conditions like arthritis, heart disease, diabetes, and Alzheimer's disease can require ongoing medication, specialized treatments, and regular checkups, all of which contribute to substantial financial strain over time. Understanding the potential for these conditions and their associated costs is essential for comprehensive financial planning.

The cost of medications, therapies, and potential hospital stays can quickly accumulate, especially if multiple conditions arise simultaneously. Recognizing this potential and proactively seeking out cost-effective healthcare solutions, such as preventative care and exploring different insurance options, is vital to managing these expenses effectively.

Impact on Retirement Savings

Unforeseen health issues and the associated costs can significantly impact retirement savings, potentially jeopardizing a comfortable retirement lifestyle. Unexpected medical expenses can deplete savings intended for retirement, forcing individuals to adjust their plans and potentially leading to a less secure financial future. It's crucial to factor in the potential for health-related costs when determining retirement savings goals.

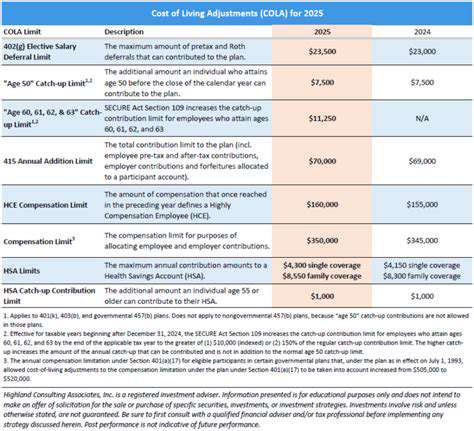

Careful financial planning that accounts for potential healthcare expenses throughout retirement is essential for maintaining financial security. Strategies like exploring health savings accounts (HSAs) or maximizing retirement plan contributions can help offset these future costs and ensure a more comfortable retirement.

Reduced Income and Increased Expenses

Aging can sometimes lead to reduced income, whether due to retirement or health-related limitations on work capacity. This decrease in income, coupled with the potential increase in healthcare and long-term care costs, can create a significant financial burden. Understanding this potential shift in income and expense dynamics is critical when planning for the future.

Adapting financial strategies to accommodate reduced income and increased healthcare costs is vital. This might involve exploring different investment options, reducing unnecessary expenses, or seeking financial guidance from qualified professionals. Proactive planning is key to navigating these potentially challenging financial transitions.

Read more about The Financial Costs of Adopting a Pet

Hot Recommendations

- Review: [Specific Brand] Small Animal Cage

- Why Rescuing Pets Saves Lives

- Best Pet First Aid Kits [What to Include]

- How to Help Stray Animals in Your Community

- Guide to Adopting a Pet When You Have Kids

- Top Reptile Heat Lamps

- Heartwarming Rescue Stories That Will Inspire You

- Review: [Specific Brand] Bird Cage

- Best Aquarium Filters [2025 Review]

- Review: [Specific Brand] Smart Litter Box

![A Week in the Life of My [Pet's Name]](/static/images/33/2025-05/DinnertimeDelightsandEveningEntertainment.jpg)

![My Experience Rescuing a Small Animal [Story]](/static/images/33/2025-05/AJourneyHomeandCaringfortheTinyTraveler.jpg)

![Life with My [Specific Exotic Pet]](/static/images/33/2025-06/ChoosingtheRightExoticPet3AResearchandPreparation.jpg)